Many brokers imagine when adding LPs into their network, the extra the merrier. As opposed to utilizing an external value feed to conduct inner order execution, some brokers use an automated dealing desk and generate their own quotes. The algorithm will either settle for the order, requote the order at another worth or simply reject it. A market-making algorithm can skew the price in a selected direction in accordance with the scale of the firm’s net open position. This allows them to coordinate and establish bid/ask costs, thus generating a sort of inner market.

Any particular person forex broker firm will handle solely a small portion of the volume of the general international trade market. Trading costs and fees can considerably influence your general profitability. Different brokers make use of various payment constructions, similar to spreads and commissions.

Although this will likely result in higher transaction prices compared to market makers, ECN brokers provide higher transparency and extra correct pricing. They also permit for the use of superior trading strategies, such as scalping and hedging. One of the first functions of a forex dealer is to grant traders access to the global foreign exchange market. Brokers act as a gateway, allowing people to take part in forex buying and selling by connecting them to the vast community of economic establishments and different traders. Some large retail brokers have tens of hundreds of small trading accounts. Instead of using STP to hedge those orders, they can permit these trades to internet off internally whereas still using exterior reference costs, usually from a liquidity provider.

- This entails processing deposits, withdrawals, and ensuring the safety of monetary transactions.

- learn providers provision phrases carefully, compare spreads and commissions, lists

- As a result, they have in depth management over transactions and might supply merchants an in-depth view of the market.

- Because the foreign exchange market is decentralised, there are several well-known foreign exchange ECNs, corresponding to Currenex, LMAX and Integral.

- It’s important to research and compares different varieties of brokers before selecting one, as every type has its personal advantages and disadvantages relying in your trading needs and preferences.

Traders could have the likelihood to carry out their operations with access to the market order book and will have an overview of the market and its movement in actual time. You have in all probability already heard of huge firms that have a trading desk. They are generally recognized as Market Maker or DD dealer (dealing desk), and they truly build an inside market, so they do not depend upon interbank liquidity. Find out about strategies of

Commerce

At Scandinavian Capital Markets, we solely act as a broker who negotiates phrases and connects shoppers with varied liquidity sources, depending on their needs. There is not a lot ambiguity around that apply, however if you would like to understand what we do behind the scenes, read our latest article on how we build one of the best foreign exchange liquidity feeds. In this text, we take a look at different models (that Scandinavian Capital Markets does not essentially use) forex brokers use to execute trades and to offer liquidity. STP brokers mix the options of both market makers and ECN brokers.

As a rule, terminals on the Forex market are provided for free, however within the case of trading on stock markets, one may need to pay. Terminals which would possibly be meant for buying and selling on such

Electronic Communication Network (ecn) Brokers:

STP brokers typically provide variable spreads, which may be narrower than these offered by market makers. This makes them a preferred selection amongst traders who prioritize tight spreads and environment friendly order execution. In the expansive realm of foreign foreign money trading, a forex broker serves as a crucial intermediary between particular person traders and the international exchange market.

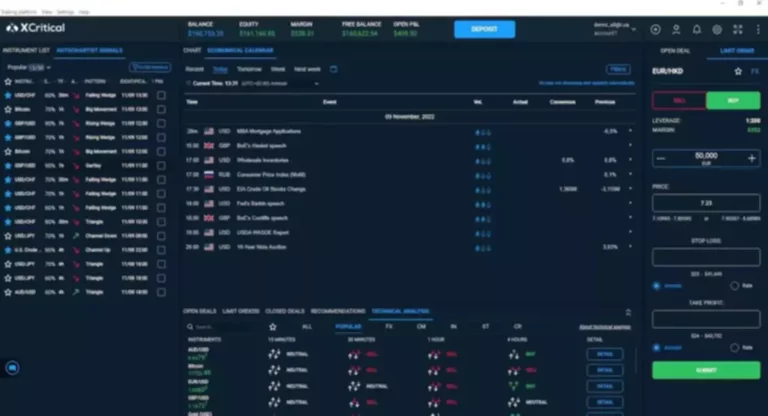

Whether it’s market makers, ECN brokers, STP brokers, or NDD brokers, every type has its unique advantages and considerations. Traders ought to fastidiously consider their trading style, preferences, and goals to pick a dealer that best suits their needs. Forex trading has gained important popularity over the years, with individuals and establishments alike seeking types of forex brokers to capitalize on the alternatives introduced by the worldwide forex markets. However, before diving into the world of Forex trading, it is essential to grasp the position of Forex brokers and the assorted kinds of services they offer. Forex brokers present buying and selling platforms, software program that permits users to execute trades, analyze market developments, and manage their portfolios.

From facilitating trades and executing orders to providing important market analysis and academic sources, the functions of a foreign exchange dealer are multifaceted. Choosing a reputable dealer is a critical choice for any dealer, because it immediately impacts their entry to the market and the overall buying and selling expertise. As you embark in your forex trading journey, understanding the position of a foreign exchange broker is essential to creating knowledgeable choices and optimizing your trading technique. Most of them additionally work by electing to quote beneath or above the real-time market prices at a given time.

a dealer requires entry to the interbank Forex market, which is offered by a dealer. On the Forex market, a dealer fulfills the above-mentioned capabilities and acts as an

Understanding The Foreign Exchange Broker

Scandinavian Capital Markets may reject any applicant from any jurisdiction at their sole discretion without the requirement to clarify the explanation why. The first thing one ought to pay attention to is whether or not a broker has an entire bundle of licenses and permits for working on the Forex market or not. The foreign exchange trade is regulated by the Commodity Futures Trading Commission and the National Futures Association.

Since the start of the twenty-first century, the web trading trade has exploded. It’s now not just top-tier monetary services corporations shopping for, promoting and trading FX at inter-bank rates. On the opposite hand, this kind of Forex broker accepts numerous buying and selling methods corresponding to scalping and swing, so it is the most well-liked kind of broker in Social Trading.

Both types of NDD brokers supply traders transparency and aggressive pricing. Market makers, also referred to as dealing desk brokers, are the most common sort of Forex brokers. These brokers create a marketplace for merchants by taking the other facet of their trades.

What Is A Foreign Exchange Broker?

It was simple to keep away from the anticipated requirements concerned in operating a sound brokerage, like safeguarding consumer cash, execution insurance policies and report maintaining. These bucket shops were in a position to onboard inexperienced merchants and pocket their inevitable losses by running a B-Book mannequin. A-Book brokers are generally generally known as company brokers, as they simply act as a middleman or an agent. B-Book brokers are known as market makers as a outcome of they do not connect with the market; rather, they function an inner market.

Given the distinct difference between these two working models, there has been a substantial dialogue among foreign exchange industry pundits and regulatory authorities on how these should be seen. It’s essential to analysis and compares various varieties of brokers earlier than selecting one, as every kind has its personal advantages and drawbacks relying on your trading wants and preferences. For some, this option could be very interesting, nevertheless it requires a very clear working coverage. That is why you need to rigorously analyze the kinds of Forex brokers and what you are interested in constructing or using, at all times evaluating your actual possibilities and the direction of your corporation. This signifies that you want to rigorously select a provider that is appropriate in your operations. Also understand that the velocity of connection and price volatility in the market might cause some discrepancy when displaying the results.

Depending on the country the trader is buying and selling from, that leverage can be 30 to four hundred instances the quantity out there in the trading account. Transactions within the forex market are at all times between a pair of two different currencies. Regulatory authorities usually publish information https://www.xcritical.in/ about disciplinary actions, offering transparency and allowing merchants to make knowledgeable selections. Consider a broker who has two LPs and has deployed capital with every provider. That means the broker has twice as much liquidity, but half of it is phantom prices. Theoretically, an A-Book dealer can STP clients’ orders to a B-Book dealer.

Facilitating monetary transactions is another very important operate of foreign exchange brokers. They handle the transfer of funds between traders and the liquidity providers available within the market. This entails processing deposits, withdrawals, and making certain the safety of monetary transactions. STP NDD brokers routinely route clients’ orders to liquidity providers, guaranteeing fast and environment friendly execution. On the other hand, ECN NDD brokers aggregate prices from multiple liquidity providers and show the best obtainable bid and ask prices to purchasers.

Can I Take Benefit Of A Forex Robotic On My Phone?

Understand the leverage choices offered by the dealer and ensure they align together with your danger management technique. Forex brokers often offer totally different account sorts to cater to varied buying and selling wants. Explore the choices obtainable and choose an account type that aligns with your experience stage, buying and selling technique, and threat tolerance.

Working with a dealing desk is a clever transfer for beginning and expert traders who don’t wish to commerce immediately with liquidity suppliers. STP brokers can directly move trading orders into their liquidity suppliers. STP brokers that work with many liquidity providers also can present their traders with higher probabilities to achieve the forex market. B-Book forex brokers operate a extra difficult and opaque enterprise mannequin, and lots of traders really feel they’ve a conflict of interest because their business model depends on buyer losses. B-Book brokers use several strategies to deal with their customers’ order flow; they could operate a dealing desk, net long and quick publicity internally or hedge with liquidity providers. No Dealing Desk forex brokersallow foreign exchange traders to have direct access into the interbank market.

These brokers have primarily developed their own inside order matching engines, or rather offsetting engines. When publicity grows on one aspect, they merely hedge the chance and cut back the position as the interior book turns into extra balanced. A-Book brokers have become increasingly uncommon in the retail forex trading sector and infrequently cater to investors with extra significant amounts of capital. When the Swiss National Bank unpegged the franc from the euro, most brokers operated an A-Book model. Most brokers basically delegated all risk-taking and danger management to their liquidity providers.